TSXV: OBUL

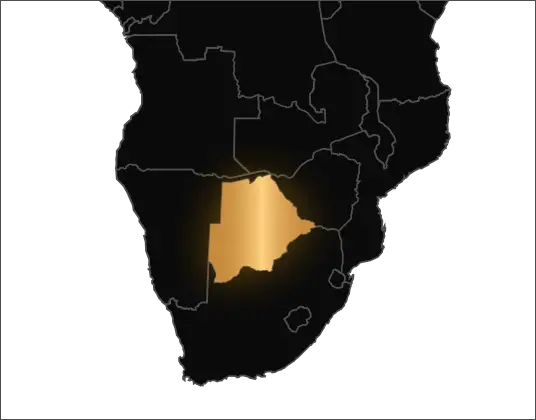

Spanning hundreds of square kilometers across the Kraaipan region, our Kraaipan, Maitengwe, and Vuma projects position One Bullion at the forefront of gold exploration in southern Africa. Each site offers unique geological potential, with ongoing exploration targeting both near-surface high-grade deposits and deeper, large-scale mineral systems.

Since the inception of One Bullion Ltd., we noticed the growing demand for metals in multiple industries and we set out to fulfill those needs. Our processes and execution greatly considers environmental impacts focusing on preservation while also providing for and supporting local communities economic support. This allows these communities to develop further while building up core, transferable skills to the local workers.

Our goal is to ensure that there’s a balance between great environmental practices, have the local communities that we work with grow and evolve, and provide our stakeholders with the value they are expecting for our mining operations and exploration.

Acquired on Kraaipan Project

Acquired on Vumba Project

Acquired on Maitengwe Project

Completed IP Surverying

Drill Program

Acquired on Kraaipan Project

Acquired on Vumba Project

Acquired on Maitengwe Project

Completed IP Surverying

Drill Program

It consistently scores among the top destinations for mining investment due to its strong administration, security, legal framework, transparent taxation regime, and long-standing political stability. Together, these factors create a secure, low-risk, and highly attractive environment for gold exploration and development, supported by clear regulations and a pro-mining government.

Our AI-driven targeting has identified 3 major gold zones, confirmed by follow-up drilling, reducing exploration risk and accelerating discovery. Over 2,000 km of Induced Polarization (IP) surveying completed across Kraaipan, Vumba, and Maitengwe.

Our management team has half a century of combined experience and a successful track record of building over 42 mines worldwide.

CEO & PRESIDENT

Mr. Berk graduated from the Cornell University with a degree finance and hospitality management, followed by an MBA from the University of Miami.

Mr. Berk’s most notable experience includes over five years as Chairman and CEO of Stem Holdings, three years as CEO of HYD for Men, and Co-CEO of Osmio, LLC. Osmio was acquired by SeamlessWeb which was subsequently sold to GrubHub (NAS-DAQ:GRUB) in 2013.

COO

Mr. Brand is a Namibian entrepreneur with 15 years of experience working on major construction and mining projects in Africa.

He has negotiated uranium off-take agreements on behalf of Soupamine with utilities providers around the world. Arno has generated over 1.5 billion dollars for shareholders in taking private companies public & has held various roles in several com-panies over his career, including CEO, COO, Director, and Project Manager.

MINE MANAGER

Mr. Silver brings over 42 years of mining experience, having served as Mine Manager, COO, and CEO.

He is now a senior mining consultant and Mine Manager at Gratomic. His background includes leadership roles in Africa, focusing on project improvements and operational efficiency. Manie is skilled in strategic planning, mine planning, and project turnarounds, and has worked with companies like The Highland Group to enhance financial and operational

Mr Hensman has held various leadership positions including Chairman & CEO of Scotia Capital (USA) Inc. (1999- 2002) and Managing Director at Scotia Capital Inc (UK) (1987-1999). He has served as the Chairman of the Board of Governors of Cl Funds, Chairman of Creststreet Power & Income Fund and Chairman of Creststreet Asset Management. Other roles include Director positions at Brazalta Resources, Canacol Energy and Rifco Inc. He is currently a director of VM Agritech Ltd. Mr Hensman began his career as an investment analyst and portfolio manager at the Sun Life Assurance Company of Canada (1981-1986).

Sheldon is a seasoned investor and entrepreneur, serving as Chairman and CEO of ThreeD Capital, a venture firm specializing in junior resource, technology, and biotech investments. As the founder of Pinetree Capital, he was instrumental in creating significant shareholder value through early investments in high-growth companies. Notable successes include Queenstone Mining, Aurelian Resources, and Gold Eagle Mines, which were acquired for a combined total of over $3 billion. His strategic vision and leadership have made a lasting impact on the venture capital and mining sectors.

Adrian has a deep background in investment management, specializing in equities, high-yield debt, and arbitrage strategies. Before joining Bromma in 2024, he was Vice President and Portfolio Manager at K2 & Associates, focusing on energy and venture growth sectors. Prior to that, he worked as an energy analyst at Acuity Investment Management and AGF Investments. Adrian is a CFA Charterholder and holds a Bachelor of Commerce from Toronto Metropolitan University, where he developed his expertise in finance and investment strategies.

With over three decades of experience in mining and finance, Peter has spent 10 years in underground mining and 23 years in capital markets. As the founder and managing director of a boutique Australian stock brokerage for 16 years, he played a key role in capital markets and investment strategies. He has also been actively involved in the cryptocurrency sector. Peter holds a Bachelor of Business majoring in Finance from Charles Sturt University in NSW, Australia.